In Property Damage insurance programs, the quality and justification of insured values have become a central lever for negotiating appropriate premiums, while avoiding both underinsurance and overinsurance.

Several international studies show that between 60% and 80% of companies face situations of partial underinsurance, mainly due to incomplete, heterogeneous, or insufficiently updated values.* In a more constrained insurance market, this reality places insured values at the heart of discussions between companies, brokers, and insurers.

For Risk Manager, the challenge is very concrete: these values directly shape the understanding of risk, underwriting assumptions and the quality of dialogue with insurers and brokers.

In practice, insured values are often built from multiple sources, updated at different rhythms across sites and based on varying levels of detail.

The central question then becomes: how can companies produce a consolidated and objective view of their insured asset portfolio, in a format that is both understandable and shareable, without excessively increasing the internal workload?

This is precisely what the SENOEE approach enables: turning valuation into a governance tool, leveraging algorithmic capabilities but only because they are built on a robust foundation: data derived from insurance appraisals, structured and standardized.

*Source : Allianz Global Corporate & Specialty (AGCS) – Global Underinsurance Report ; Aon – Global Risk Management Survey.

Insured values: an increasingly structuring issue for Risk Managers

The role of the Risk Manager sits at the intersection of three constraints: the need for justification, the growing complexity of insured perimeters and the necessity to arbitrate. Even when internal teams invest significant effort, producing homogeneous and comparable values becomes increasingly difficult as organizations grow, transform, acquire new sites, change scope, or operate across multiple countries.

What is expected today is not merely “a value,” but a value that is explainable, comparable from one site to another, and sufficiently structured to be integrated into discussions with insurance partners. Failing this, insurance programs become harder to manage: prioritization becomes uncertain, discrepancies are difficult to objectify, and discussions tend to stall on methodology rather than on the actual risk exposure.

Site-by-site valuation: necessary, but insufficient at company (or group) level

Insurance appraisal remains the cornerstone of the profession. It provides a technical reading of sites, activities, assets and constitutes a reliable reference base.

It is essential for qualifying reality, documenting assumptions, and establishing values within a rigorous framework.

Difficulties arise when organizations need to scale.

According to FERMA, more than 65% of European Risk Managers* report difficulties consolidating values at a multi-site level, mainly due to heterogeneous methodologies, differing reference frameworks, and misaligned update cycles.

When data is dispersed, methods vary from site to site, and levels of detail are inconsistent, consolidation becomes a heavy, sometimes fragile exercise—rarely suitable for direct sharing with insurance stakeholders.

The challenge is not to replace insurance appraisal, but to extend its value across the insured portfolio.

*Sources FERMA –European Risk Manager Survey ; Marsh – Property Insurance Market Update

Algorithmic valuation: a coherence lever grounded in insurance appraisal

At SENOEE, algorithmic valuation is not an “automatic” estimate disconnected from the field. It follows the opposite logic: starting from reliable data derived from insurance appraisals, then structuring and standardizing that data to build a unique algorithmic reference framework.

This step is decisive.Once structured and normalized, appraisal data becomes scalable: it feeds models designed to check the consistency of declared values and to produce precise, comparable estimates based on sites and activities that have already been appraised.

This is where algorithms truly make sense for Risk Managers: they bring methodological coherence at a multi-site level and enable comparison within a homogeneous framework. The outputs are not simply “additional figures.”

They are delivered in a format aligned with traditional insurance appraisal reports readable, traceable and justifiable within the insurance ecosystem.

In practical terms, the value proposition is straightforward: transform a collection of field data into a consolidated and objective view of the insured asset portfolio, usable for governance, explanation, and arbitration.

This need for coherence is reinforced by the rapid evolution of values under external pressures.

Between 2020 and 2023, reconstruction costs increased by 20% to 35% on average in Europe*, driven by material inflation, labor shortages, and evolving standards.

In such a context, static valuation quickly loses relevance. Algorithmic valuation makes it possible to embed insured values within a governance logic, relying on structured, comparable data derived from real appraisals rather than on ad hoc or purely declarative adjustments.

*source : Marsh – Global Property Insurance Update; Swiss Re – Sigma Report on Property Inflation

How SENOEE’s algorithmic valuation is used to govern insured values

Once the reference framework is established, SENOEE’s algorithmic valuation serves two core uses that directly address Risk Managers’ constraints.

- First, it enables consistency checks of declared values The objective is not correction for its own sake, but objectification: identifying significant discrepancies, highlighting areas requiring priority attention, and providing a more structured basis for discussion.

- Second, it enables estimations for non-appraised sites, based on data from already appraised sites and standardized information. This addresses a frequent need: maintaining a coherent view across the insured perimeter, even when not all sites can be appraised at the same depth immediately.

In both cases, the aim is highly operational: homogeneous, comparable valuations presented in a justifiable format.

This approach also reduces the burden on internal stakeholders (Finance, Technical, Real Estate teams), who are often asked to reconstruct data from accounting values (acquisition cost, depreciation) that are not always suited to insurance purposes.

Finally, SENOEE defines different levels of valuation, enabling organizations to optimize time and budgets allocated to asset valuation while embedding a logic of continuous improvement over time.

Valuation classes: establishing a shared language with insurers

One aspect of value management is often underestimated: the quality of dialogue also depends on the ability to qualify the level of valuation.

A value does not carry the same weight or purpose depending on whether it results from a detailed on-site appraisal, a structured consolidation, or an estimate based on an algorithmic reference framework.

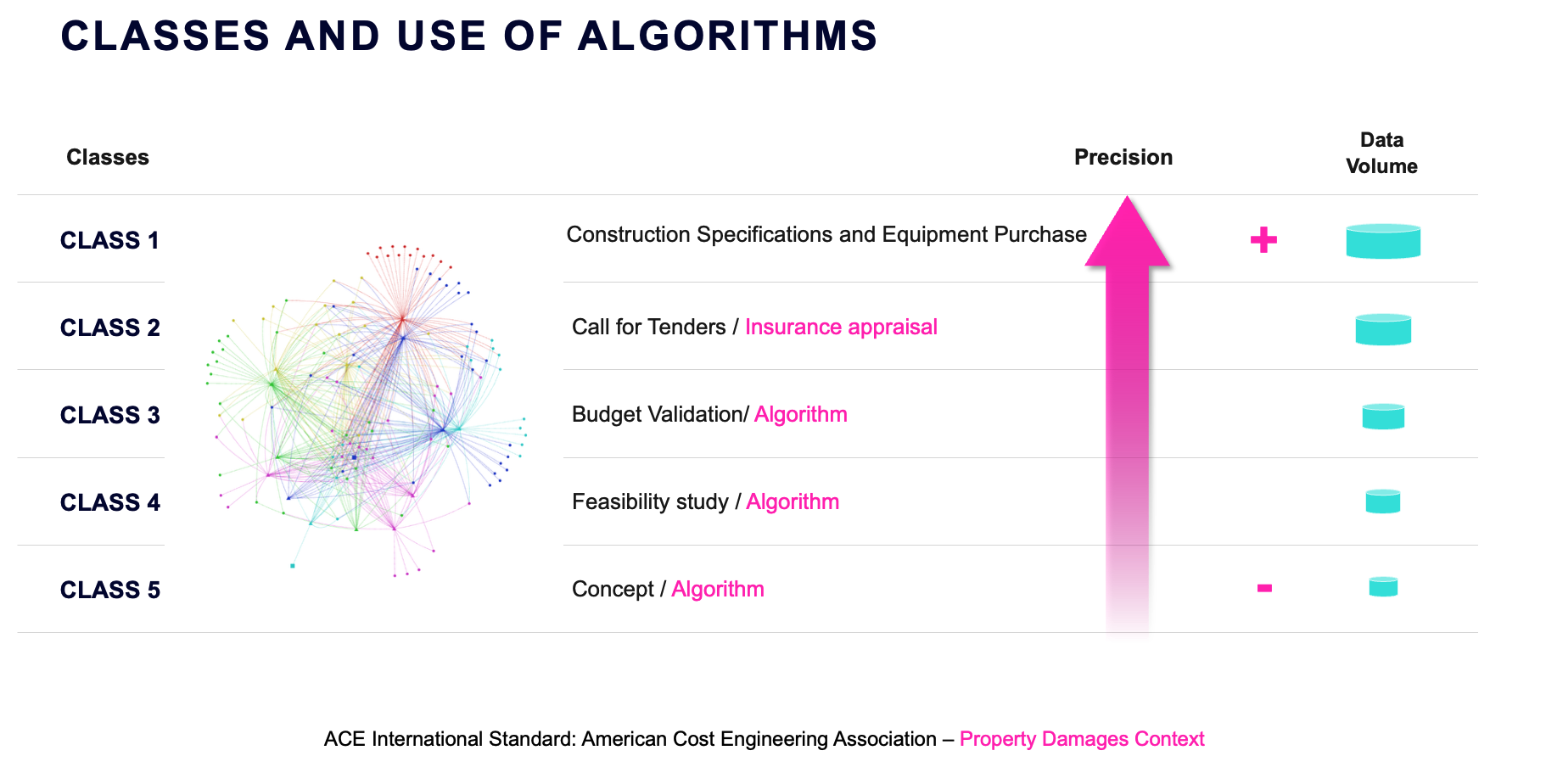

To ensure clear communication with insurance partners, SENOEE has defined a structured classification of valuation levels. This framework positions each estimate within a common reference, facilitating interpretation, comparison, and integration into underwriting and renewal processes.

A structured classification of valuation levels

In this context, valuation classes play a pedagogical role: enabling Risk Managers to clearly define their perimeter, explain levels of depth by area or site, and share a more intelligible reading with brokers and insurers without overloading submissions with unnecessary detail. Some valuation levels are aligned with internationally recognized reference frameworks, notably those of the American Cost Engineering Association (AACE) for Property Damage values. This compatibility strengthens clarity, particularly in multi-country or internpational environments.

What this changes in practice for Risk Managers

The value of algorithmic valuation does not lie in adding yet another tool, but in improving governance.

For Risk Managers, this translates into a consolidated and objective view of the insured asset portfolio, with homogeneous and comparable values across the entire perimeter.

This coherence facilitates prioritization: identifying where valuation depth needs reinforcement, distinguishing critical issues from minor adjustments, and building a progressive roadmap rather than addressing everything at once.

The quality of dialogue with insurance partners also evolves. Traceable, justifiable values presented in a homogeneous format improve file readability and strengthen the ability to explain assumptions.

The discussion shifts: less time spent reconstructing or harmonizing data, more time devoted to meaningful arbitration.

Finally, organizations gain continuity. Structured data becomes a reference framework rather than a one-off deliverable. This is what enables year-after-year governance instead of repeated restarts.

Algorithmic valuation, as approached by SENOEE, is not a technological promise. It is a methodological approach grounded in insurance appraisal, data structuring, and proprietary algorithms capable of producing homogeneous, traceable, and justifiable valuations across multi-site portfolios.

Do you want to assess your current level of coherence, clarify your governance needs, or structure a valuation roadmap tailored to your perimeter?

Discuss with SENOEE teams the most relevant options, in a format aligned with broker and insurer expectations.