INSURANCE APPRAISAL

Ensure the reliability of the preliminary assessment of your insured sites.

Rely on structured and consistent field data collection to produce justifiable and comparable technical values.

Senoee combines the historical know-how of insurance appraisal, with the power of algorithms to ensure the reliability of declared values in property damage insurance. Our approach guarantees structured, comparable, and objective data, serving a better control of insurance risk. It enables you to improve your premium

Insurance appraisal makes it possible to determine a company's insurable capital.

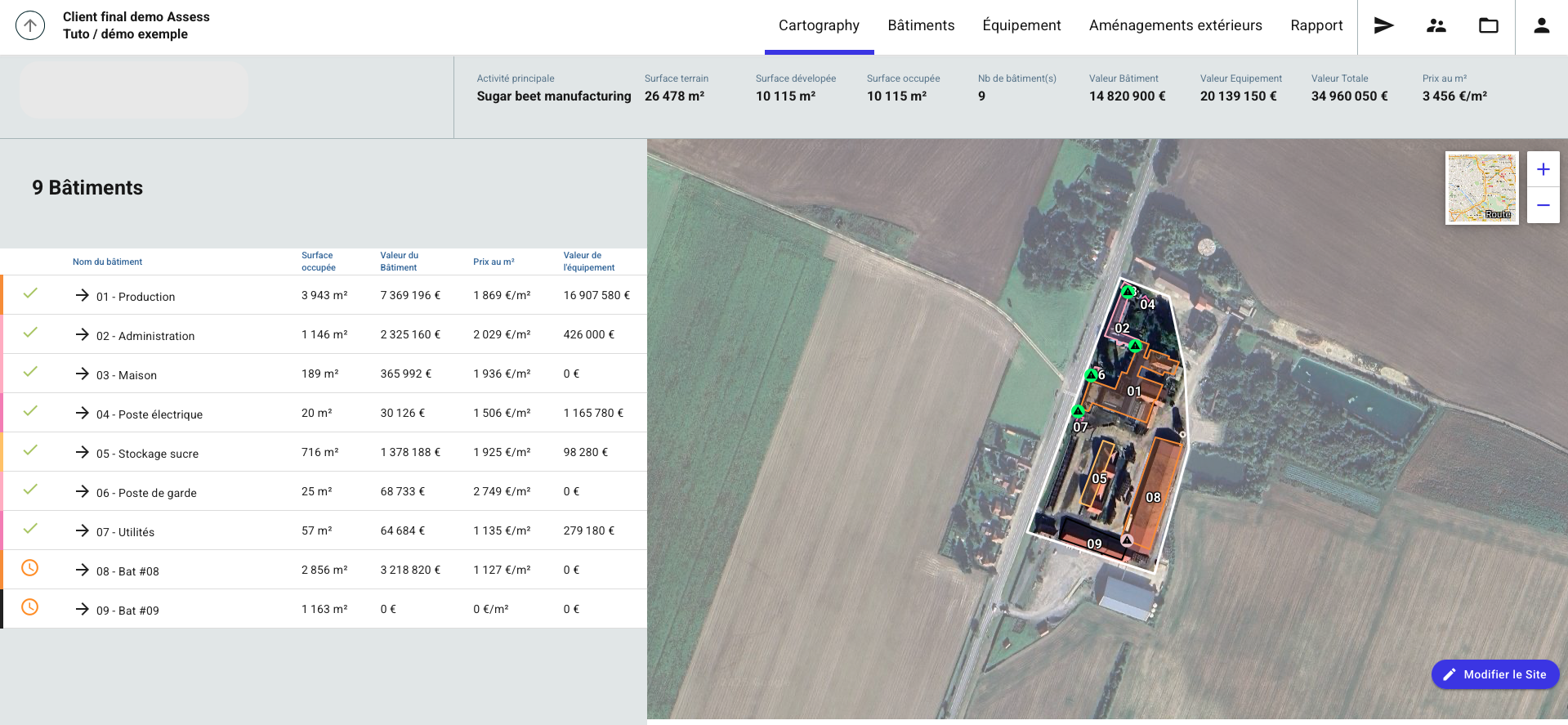

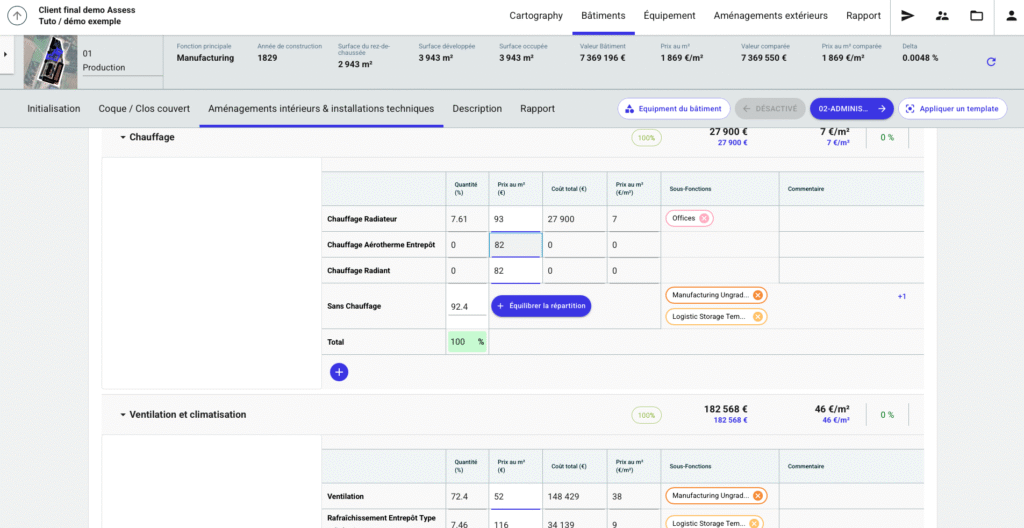

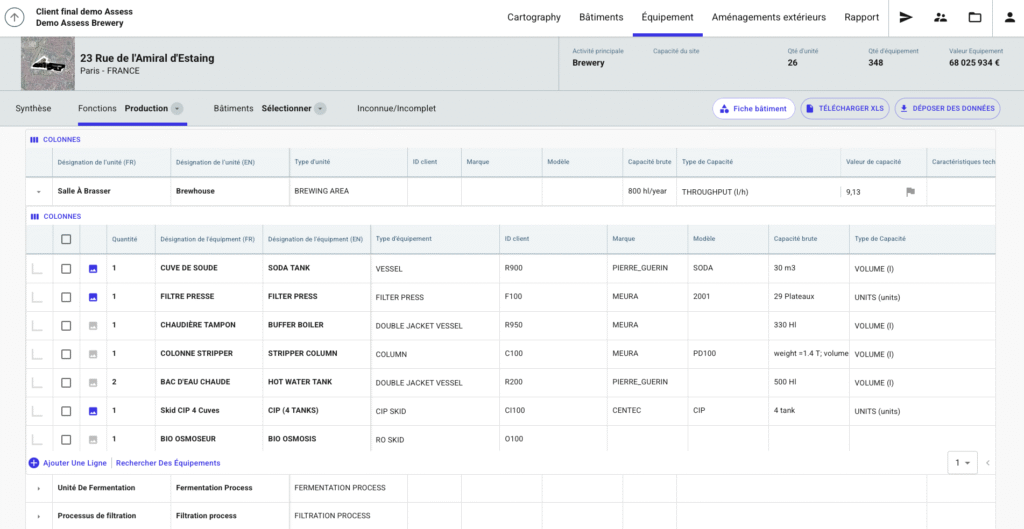

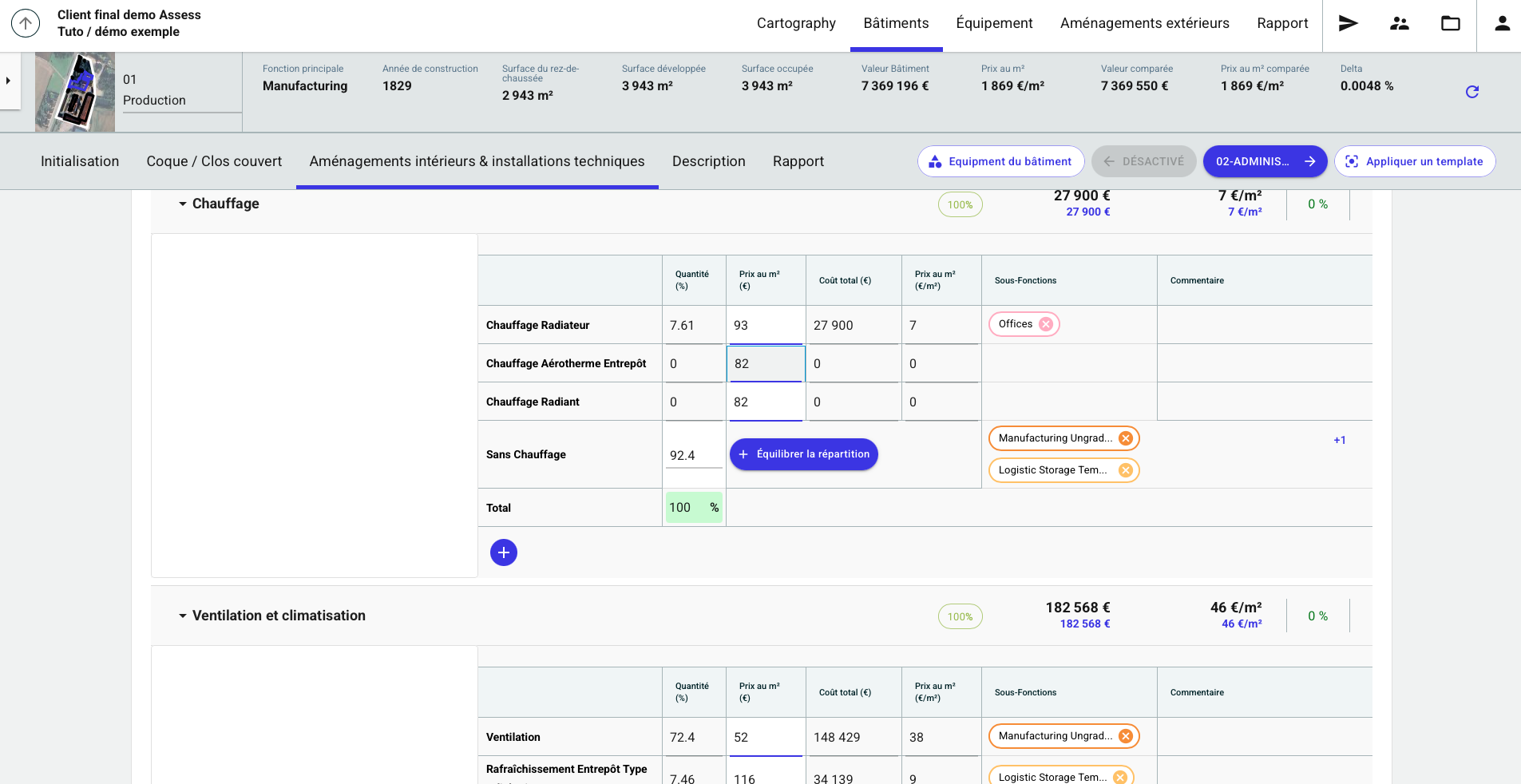

Conducted on-site, it involves identifying all assets (buildings, equipment, installations) and assessing them at their new value (reconstruction or identical replacement) as well as at their depreciated value.Beyond financial estimates, insurance appraisal also includes precise technical information about the buildings and equipment, thus providing a complete and objective view of the insured assets.

Objectives of insurance appraisal

Insurance appraisal aims to ensure the reliability of the value of insured assets, whether they are building or equipment property, to provide coverage adapted to the actual risk. It allows to :

- Determine the fair insurance value of the company's assets

- Avoid undervaluation that could lead to proportional rules on capital in the event of a claim

- Prevent overvaluations and thus excessive premiums, especially when optimizing contracts for multi-site assets

- Facilitate indemnity procedures with clear and consistent data

- Have a detailed asset report presenting an inventory valued at replacement cost and depreciated value, which can be updated annually

Insurance appraisal is not limited to the visited site: it constitutes the basis for a homogeneous reading of the assets at the scale of the company.

This comparability between sites is essential for Risk Managers, brokers, and insurers, who must be able to analyze and consolidate the insured values on objective bases.

To address these challenges, Senoee has developed a standardized data collection and valuation methodology, allowing our experts to produce coherent and exploitable reports.It is with this logic that we created the tool Assess, designed to share a common practice and ensure the reliability of asset valuation on a large scale.

ASSESS, l’allié de nos experts

ASSESS is the expertise tool developed by Senoee to structure, consolidate, and value the data collected on site.

It enables optimization of the insurance appraisal time while guaranteeing coherence and comparability of information across different sites.

Its main features are:

- Customized technical data collection for intuitive and consistent input on-site

- Automatic structuring and standardization of expertise data

- Integrated valuationbased on Senoee’s reference frameworks and calculation models

- Generation of dynamic and personalized reports

- Full interoperability between different expertises for consolidated asset portfolio analysis